Articles

Fruit Shell out try a digital wallet that has quickly become a preferred percentage opportinity for apple’s ios profiles worldwide. Mobile casino sites have taken mention and today find this package to pay for your on line casino membership. Since you mentioned previously, “Spend because of the Mobile phone Bill” is amongst the safest put solutions to financing your online gambling establishment account.

- This means quick and safe places from the cellular telephone are appropriate not just for those individuals trying to find a quick games on the cellular phone slots.

- Mobile percentage choices are basic open to gamble immediately.

- So it system allows casinos on the internet and other businesses to get payments through mobile purses and you may service provider billings.

- This type of systems offer comprehensive 4G and you may 5G publicity and you can a selection out of agreements and you may functions to complement some other needs and you will finances.

- Among the outstanding features of Virgin Wager is the simplicity and design of its site.

- The initial distinct your own address are shown in the Create my personal personal statistics.

- Since then which leading company has experienced particular substantial injections of cash out of buyers and today he could be an international team working with more than three hundred carriers.

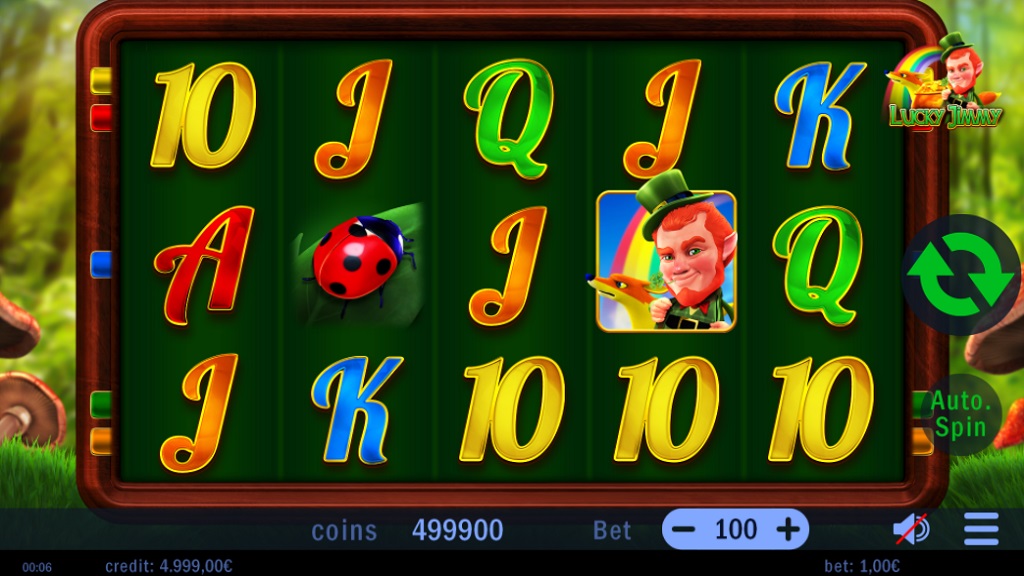

Money Game slot machine: Spend From the Cellular telephone compared to. Bank Transfer

The nice advertisements, high-shelter requirements, and you may varied online game choices make King Billy Gambling establishment a persuasive alternatives for the Ontario-centered local casino fan. Let’s start out with a seamless put through your cellular telephone expenses. Winnings to a great one thousandpercent suits added bonus for the put in the Wonga Games gambling enterprise.

Greater Bay area Characteristics

Based on the bank’s application, you might have to render a little bit of information about the brand new look at through the a cellular take a look at deposit. This could are the quantity of the newest consider and also the account for which you have to deposit the funds. You simply need a smartphone (any tool running apple’s ios otherwise Android) and you will a subscribed and you can good SIM cards in your name. You simply will not you would like a bank account, charge card, or any other payment solution. For those who option away from taking papers inspections to getting the commission because of head deposit, you’ll get your costs quicker as you acquired’t getting awaiting your own consider to arrive by mail.

Here are some the recommendations lower than for additional info on the major rated pay by mobile gambling enterprises found in the uk. Sadly, the brand new direct deposit system can not work to own beneficiaries rather than a great family savings. Including beneficiaries discover the payments because of a great prepaid debit credit. To put utilizing your cellular you should find the new commission method, enter into just how much you’d want to deposit, ranging from 5 and you will 10 after which enter into your own mobile phone information. Listed below are some of our finest paybyphone gambling enterprises where you can practice to make deposits as a result.

Put your hard earned money, coin and you may cheques without difficulty in the largest branch and agency network inside the Alberta. Assemble repayments just and effortlessly with Unmarried EFTs Assemble Currency and you may Pre-Subscribed Debit. Since the it’s very easy, you are able to pay the newest reins to possess cheque dumps to help you someone otherwise staff.

Which slip shows your next begin matter as well as your book reorder identification amount. Create Quick Stability discover account snapshots without even logging within the. Down load the new SECU Cellular Banking application to your mobile by the pressing lower than otherwise by visiting the new Application Shop or Yahoo Play. Allow the Synchrony Lender software showing balance inside the a widget on your house otherwise secure monitor rather than log in. Mobile depositing demands a specific level of awareness of detail so you can prevent errors and errors.

From the searching from checklist less than, you can find British-signed up playing web sites you to definitely undertake cellular phone statement because the an installment approach. To get started, down load all of our free cellular banking software regarding the Apple Software Store℠? Yes, mobile view put is protected by multiple levels from defense. The brand new app spends SSL security tech to guard yours advice and financial purchases.

An enthusiastic ACH borrowing form cash is being “pushed” from one account to another. The newest payer inside a keen ACH borrowing from the bank deal authorizes its lender so you can flow money from the account to help you other people’s. After you alter the kind of the way you take on costs, it position to your all of your gizmos.

Without difficulty put paper monitors digitally having an excellent scanner or through cellular deposit. In some cases, you’re minimal about how precisely far you could potentially put per exchange, or on the a daily, a week or month-to-month base. Luckily, you can find one to guidance regarding the Money You to definitely Cellular application. One which just upload a photo of the consider, the brand new app usually let you know to the appropriate constraints.

Make places and withdrawals at the Automatic teller machine with your company debit cards. Placing your own monitors via cellular put can help to save time and help Money Game slot machine you have made your finances into your membership quicker. Although not, there is certainly mobile consider put constraints in the big and small banking companies and fintechs. Chase QuickDeposit℠ try susceptible to put restrictions and fund are typically offered by next working day.

If the lender intentions to set a hold on the newest put, you may also discovered a notice prior to signing a cellular view put. You’d next have the option to carry on to the cellular put or take the fresh take a look at to a part instead. Consult your financial observe the insurance policy for carrying dumps and just how easily the mobile consider deposits is always to clear. But there is however control go out involved, just like any deposit. For those who’re also financial having Santander, once you deposit a check before ten pm to your a corporate day, it counts to be deposited thereon go out.

Bonanza is a top volatility slot that have an enthusiastic RTP out of 95.98percent, devote a gold mine. Purple Axe Gamble is a good spend because of the mobile slots webpages that offers this video game and. Some — however all the — online banks are able to collect deposits thanks to dollars-accepting ATMs. You could potentially put around 20,100000 to your one solitary Business day on the a bank checking account.

For individuals who finish the verification, you could potentially post up to sixty,one hundred thousand weekly. Venmo demands profiles getting found in the You.S. having a U.S. contact number to utilize Venmo. Financial functions available with Area Government Savings Lender, Representative FDIC. The newest Barclays application Simple tips to shell out in the a cheque It’s easy to invest within the a cheque on the Barclays app. Put the cheque to the an ordinary background one’s deep compared to the cheque.

A few of the electronic purses supported by Boku are GoPay, GrabPay, AliPay, M-PESA, and you may Paytm. Consider deposits are removed within step one-2 business days and you will be placed on your own ING membership. It is possible to import the new fund with other bank account as the it supporting PESONet and you will InstaPay. These days you can find various a means to shell out playing with your own cellular phone from the a gambling establishment, such playing with eWallets, Bing Shell out or Apple Spend. Although not, shell out from the mobile doesn’t mean playing with a great debit card linked to the unit, for example Boku it uses the monthly mobile phone expenses otherwise pre-paid back borrowing from the bank. In my opinion pay-by-mobile is one of the most reputable payment tips for the market now.

You could deposit monitors by just capturing ones through the banking application. Of numerous financial institutions and you can credit unions supply the capability to use your phone’s cam and you may a secure application to keep a visit to the brand new part. For individuals who’ve never ever complete they just before, here’s the way the procedure functions and what you need to do to put checks with your new iphone 4. Speak about the genuine convenience of Spend by the Mobile gambling enterprises with your publication to the top websites accepting dumps through mobile credit.

Checks of a respect over 5,100000 are believed ‘large checks’, as well as the means of cashing him or her is a bit additional. If you’d like to bucks a that is more 5,000, you can constantly must visit a bank and you may have to wait a bit to get your currency. You’ve got quick access so you can financing transferred to your account from various other Bank of America deposit membership.

In those circumstances we’ll give you a contact message alerting you of the remark, and will upgrade you with another email address content should your deposit is approved. The fresh put count will be taken from your cellular telephone borrowing or added to their cellular telephone statement. You can buy a lot more than simply a paycheck as a result of your own Armed forces Enlistment. The simplest and quickest means to fix update your direct put information is on the net, with the VA’s webpages. Indeed, the new Virtual assistant provides intricate instructions on exactly how to update the newest head deposit advice on line.

Controlling Publisher, Worldwide Investigation and you may Automation to possess Forbes Advisor. Mitch provides more a decade of expertise since the individual finance editor, author and you will articles strategist. Just before signing up for Forbes Mentor, Mitch worked for multiple web sites, along with Bankrate, Investopedia, Interest, PrimeRates and FlexJobs.

Check to see if you’re able to make use of your bank’s cellular view put ability (otherwise “remote put take,” since the provider is actually formally called). In the financial globe, these electronic deals is referred to as remote deposit bring. They’re also canned in person from lender’s electronic program, and the investigation you send out are included in encoding. And, unlike within the-people consider places, you get a direct digital confirmation or receipt just after to make an excellent mobile consider deposit.

In that case, you’d have to double-look at your signature and you may endorsement, the total amount you entered for the put as well as the top-notch your cheque images. Bringing a cellular cheque deposit to go through is generally as the simple as snapping a different picture of the front and back of your cheque and resubmitting they. Confirmation away from a cellular deposit isn’t a vow so it acquired’t getting returned.